Payroll calculations

Whether its gross-to-net calculations federal and state-specific tax rates the latest payroll insights or a payroll solution that you seek our hope is. Or call us at 785-864-4385.

Chronotek Makes Payroll Simple As It Will Automatically Calculate Time Card Hours From Decimal Time To Hours And Minutes Fo Decimal Time Decimal Chart Decimals

The Bureau of Labor Statistics is the principal fact-finding agency for the Federal Government in the broad field of labor economics and statistics.

. W-2 W-3 940Schedule A 941Schedule B 944 945a 943943a 1099-MISC and 1096. For security reasons these macros are often disabled by default settings on the users computer. Instead employees accrue paid time off on regular hours worked up to 40 hours per week.

Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE. Get unlimited payroll runs automated tax filing integrations with other tools and more. Payroll Taxes has a new home.

Enhanced Payroll completes these federal payroll tax forms for you. KU Payroll is available for in-person appointments Monday through Friday from 900 am - 300 pm. The reconciliations between the YTD values and the year-end form values must match for the IRS to accept the year-end forms.

The app is inbuilt with a smooth and responsive user interface mailbox voice and video chat. Try our payroll software in a free no-obligation 30-day trial. These calculators include macros for printing worksheets adjusting display size and quitting or exiting the calculator.

New Free Accounting Software --Excel Accounting. Get unlimited payroll runs automated tax filing integrations with other tools and more. COPAC Payroll collects and pays your taxes accurately and on time.

With warm appreciation for our loyal Payroll-Taxes users weve moved the Payroll-Tax content that you rely on and trust to better serve your payroll needs. Table Name News Release Tables. We keep track of changing tax laws and do the calculations.

Payroll YTDs are required for record-keeping calculations of tax obligations and providing accurate tax documents at the year-end to employees. The word data is plural for datum When data are processed organized structured or presented in a given context so as to make them. The payroll tax rate totals 124 percent of earnings up to the taxable maximum the rate is 62 percent from workers and 62 percent from employers and 124 percent from the self-employed.

Every employer is an unpaid tax collector who must collect and pay taxes on time and in accordance with established rules and regulations in order to avoid annoying tax notices time-consuming correspondence and costly penalties. Difference between data and information what is data. The words Data and Information may look similar and many people use these words very frequently But both have lots of differences between them.

An updated look at the Toronto Blue Jays 2022 payroll table including base pay bonuses options tax allocations. Our smart payroll services make it easy to run payroll online. This funding is complimented by another recent award of 3 million in the states Fiscal Year 2022-23 budget.

View all critical payroll changes to help mitigate complications before they become big issues. Payroll calculations are a complicated process that may vary based on state and local rules and from company to company. By CBO calculations the household incomes in the first and second quintiles have an average total federal tax rate of 10 and 38 respectively.

Some companies may have their own payroll structure based on their own unique payroll components. Historical A Tables Household data. Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions.

When it comes to PTO accrual do not include overtime hours in your accrual calculations. Our cloud-based employee monitoring software is updated with cutting-edge technology making it easier for you to access employee and payroll information on any device anywhere. When it comes to processing payroll its usually best to invest in a payroll service or to work with an accountant because you avoid much of the cumbersome administrative and tax-related work.

Payroll Calculations Proof of Employment or Income Frequently Asked Questions International Employees. The payroll lobby is only available for walk-ins from 830 am. Occupation code Occupation title click on the occupation title to view its profile Level Employment Employment RSE Employment per 1000 jobs Median hourly wage.

7 March 2019 Guidance Taxable pay tables. Employment Situation News Release monthly Current Population Survey CPS. 905 Asp Avenue Room 244.

All 50 states and multi-state. Run your first payroll in 10 minutes. Online payroll for small business that is simple accurate and affordable.

Auto-calculations for fewer mistakes. Get up and running with free payroll setup and enjoy free expert support. For state forms not yet supported we provide a State Tax Summary report with all the payroll data you need.

Previous years and months. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques. This page is for employers and provides links to the current and previous years of T4032 Payroll Deductions Tables including the Federal Provincial and Territorial Income Tax Deductions the Employment Insurance premiums and the Canada Pension Plan contributions.

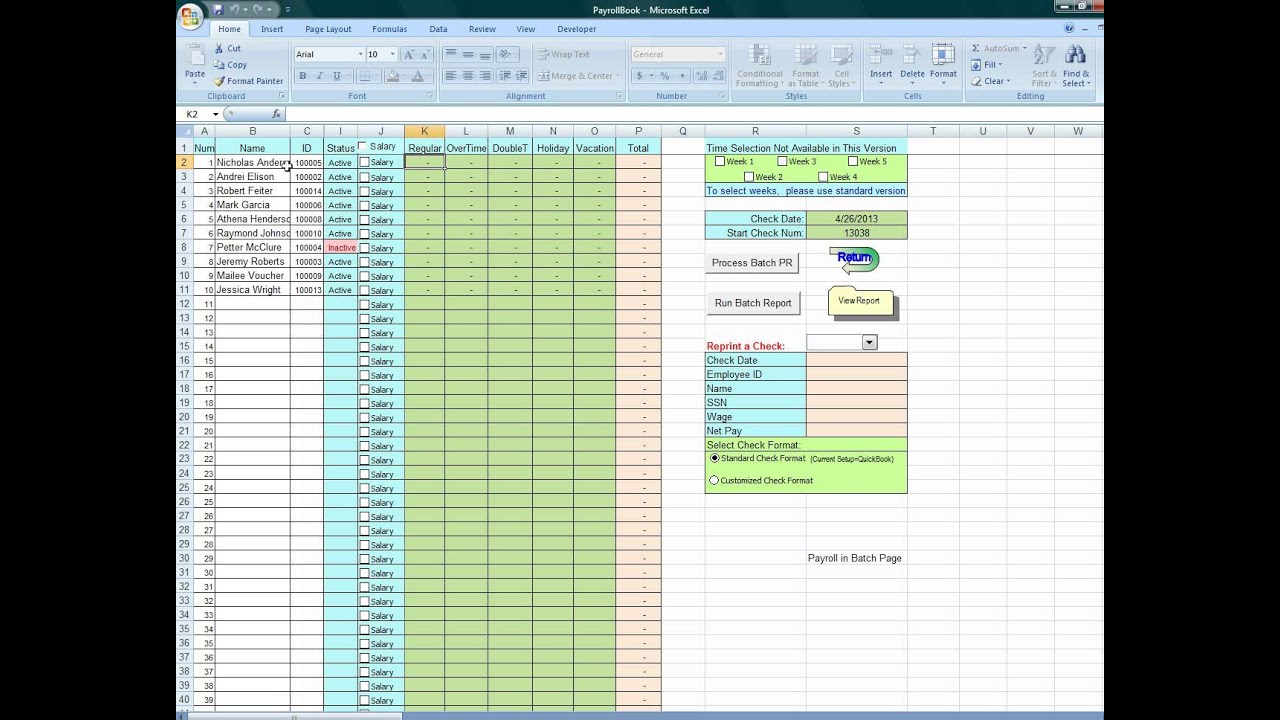

Hours of Operation Lobby Hours. This Excel Payroll Program Includes Everything You Need for Your Payroll-- Includes Everything you need for Payroll Process -- Free Excel Base VBA Payroll Program -- Prints W2 forms W3 940 941 DE9 taxes liabilities -- Prints on any types of computer checks -- Accrual Vacation workers compensation. 14 February 2022.

Read on about Dos Palos Library Project. It helps companies manage their human resources and payroll efficiently. Use the following tables to manually check your payroll calculations.

In addition to a traditional Check Register access a graphical analysis of your payroll calculations. Payroll Table 2022 Contracts Active Multi-Year Summary Positional Spending Prospects The Future Free Agents 2023. Enhanced Payroll includes many state forms.

We do the calculations you handle the rest. The Fair Labor Standards Act FLSA state and local minimum wage and overtime rules as well as other wage and hour rules. Data are plain facts.

Online payroll for small business that is simple accurate and affordable. An employer and employees need to pay attention to the year to date YTD. Your paychecks and paystubs are calculated populated and ready for printing.

Monday - Friday in accordance with the university holiday schedule and campus closures.

Nvbbmybq3aotom

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Payroll Template Bookkeeping Templates

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Worksheet Template

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Payroll Deduction Form Is The Sum Of The Wages Of All The Employees Working For An Organization A Payroll Deduction Form J Payroll Deduction Payroll Template

How To Calculate Your Net Salary Using Excel Salary Excel Ads

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Templates

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Shortcuts

Access Database For Small Business Payroll Software And Tax Templates Access Database Payroll Software Payroll

How To Prepare Payroll In Excel This Wikihow Teaches You How To Calculate Payroll For Your Employees In Microsoft Excel Creating A Payro Payroll Excel Salary

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Payroll Time Conversion Chart Payroll Calculator Decimal Time

Pin On Raj Excel

Using Excel To Process Payroll Dyi Excel Excel Calendar Template Payroll Template

Self Employment Ledger Forms Beautiful Printable Payroll Ledger Payroll Payroll Template Bookkeeping Templates

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Formula